Form 5329 Line 48

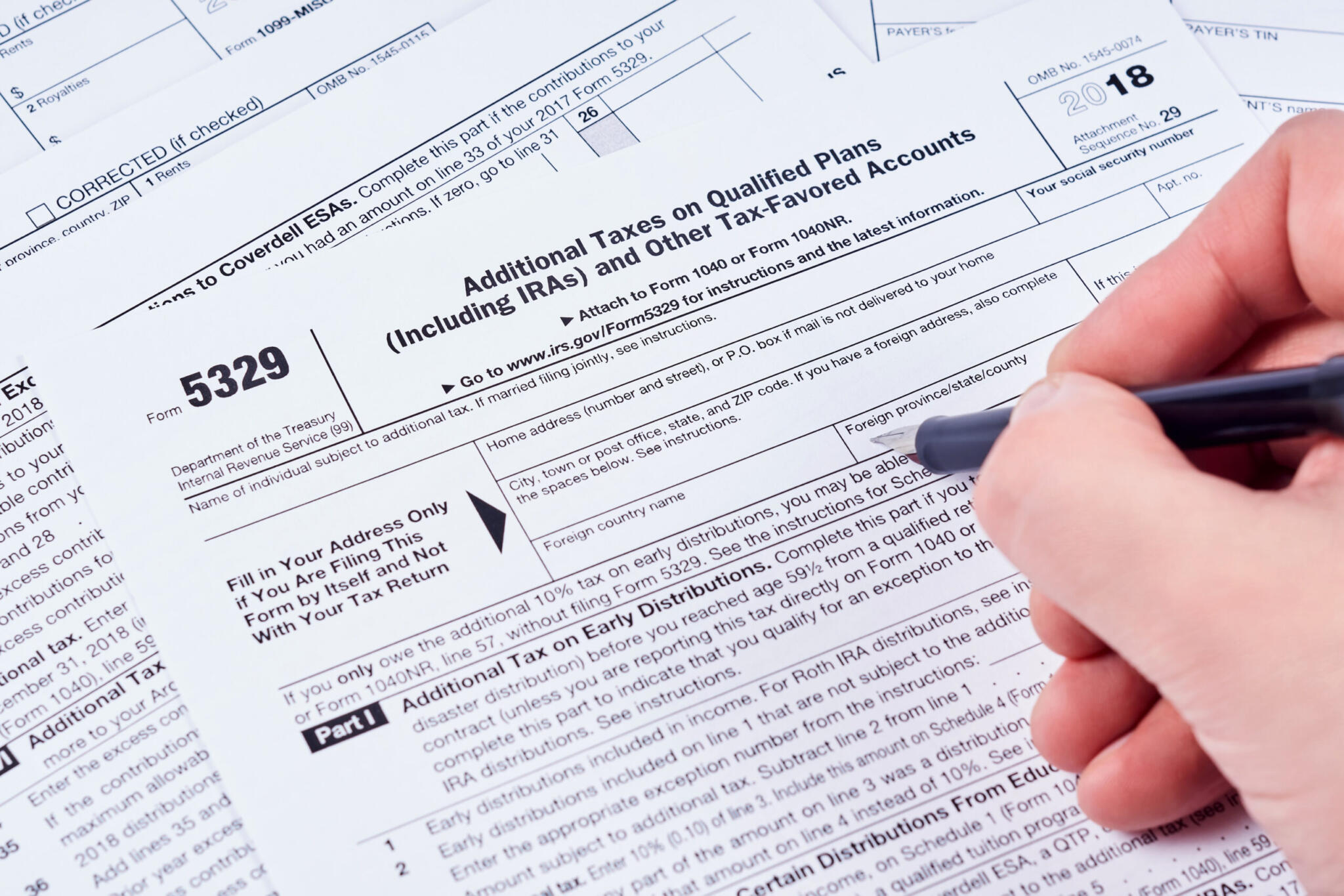

Form 5329 Line 48 - Web line 48 is simply the sum of lines 46 and 47. Web the contributions for 2020 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. Certain corrective distributions not subject to 10% early distribution tax. Web enter the amount from line 48 of your 2013 form 5329 only if the amount on line 49 of your 2013 form 5329 is more than zero. Web what's new for form 5329 for tax year 2023: Use form 5329 to report additional taxes on iras, other qualified.

Use form 5329 to report additional taxes on iras, other qualified. This was the amount by which i overfunded the hsa accounts. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). That includes making note of early distributions on form 5329. Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329).what's new for form 5329 for tax year 2023:

Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from a qualified retirement plan (including an. Web if you did not overfund your hsa in 2016, then you probably won't have a 5329 (although you might have one for other reasons, with line 48 blank). Use form 5329 to report additional taxes on iras, other qualified. Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from a qualified retirement plan (including an. Web use form 5329 to report additional taxes on: What's new for form 5329 for tax year 2023:

Web the form calculates any additional taxes owed (what are often called penalties) for certain ira transactions. Web line 48 is simply the sum of lines 46 and 47. Web what's new for form 5329 for tax year 2023:

Web Do You Mean That You Have Your 2022 Tax Return And It Doesn't Include Form 5329?

The form is filled out and submitted by the taxpayer with an. Web use form 5329 to report additional taxes on: Web complete this part if you took a taxable distribution (other than a qualified disaster distribution) before you reached age 591⁄2 from a qualified retirement plan (including an. Certain corrective distributions not subject to 10% early distribution tax.

Use Form 5329 To Report Additional Taxes On Iras, Other Qualified.

Web enter the amount from line 48 of your 2022 form 5329 only if the amount on line 49 of your 2022 form 5329 is more than zero. Beginning on december 29, 2022, the 10%. Web the form calculates any additional taxes owed (what are often called penalties) for certain ira transactions. Web what's new for form 5329 for tax year 2023:

Web Enter The Amount From Line 48 Of Your 2013 Form 5329 Only If The Amount On Line 49 Of Your 2013 Form 5329 Is More Than Zero.

For example, you may not have taken all of your. What's new for form 5329 for tax year 2023: Web in this article, you'll find answers to frequently asked questions on retirement plan taxes (form 5329). Web form 5329 is used by any individual who has established a retirement account, annuity or retirement bond.

Web Complete This Part If You Took A Taxable Distribution (Other Than A Qualified Disaster Distribution) Before You Reached Age 591⁄2 From A Qualified Retirement Plan (Including An.

This was the amount by which i overfunded the hsa accounts. Web the contributions for 2020 to your traditional iras, roth iras, coverdell esas, archer msas, hsas, or able accounts exceed your maximum contribution limit, or you had a. If contributions to your hsas for 2014 (line. If you don't have a 5329, take this as evidence that you.