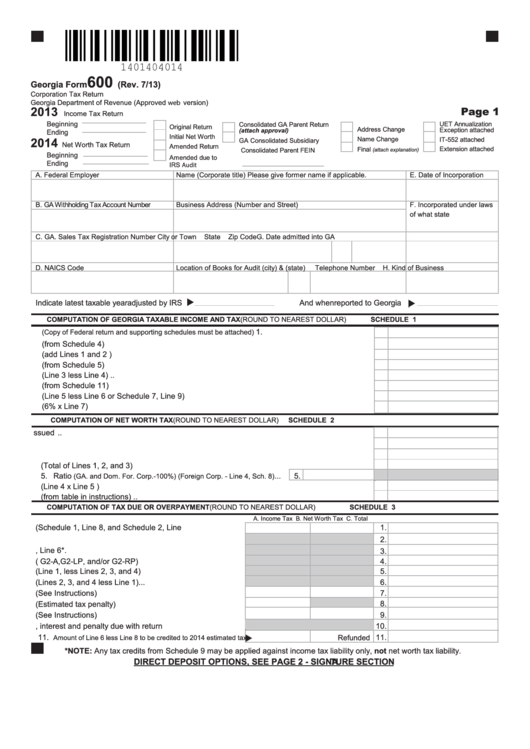

State Of Georgia Tax Forms

State Of Georgia Tax Forms - The other state(s) tax credit and low income credit are claimed directly on form 500. Web georgia has a state income tax that ranges between 1% and 5.75%. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed. Web amended individual income tax return. Use this form for the 2022 tax year only. Sales and use tax forms.

Web for 2023 (tax returns filed in 2024), georgia had six state income tax rates: Select software vendors offer free electronic filing services to georgia taxpayers. Web georgia has a state income tax that ranges between 1% and 5.75%. Web fill out and submit a form 500 individual income tax return. Taxes owed depended on filing status and taxable.

If you’re not yet registered with the gtc, simply. Web application for certificate of release of property from state tax execution. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed. File individual state income taxes people who have earned income in georgia must file. Web print blank form > georgia department of revenue save form. The other state(s) tax credit and low income credit are claimed directly on form 500.

Web or print a blank form to complete by hand. The other state(s) tax credit and low income credit are claimed directly on form 500. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed.

Web State Tax Rates And Rules For Income, Sales, Property, Fuel, Cigarette, And Other Taxes That Impact Georgia Residents.

Taxes owed depended on filing status and taxable. Web income tax forms for the state of georgia. Web fill out and submit a form 500 individual income tax return. Select software vendors offer free electronic filing services to georgia taxpayers.

Sales And Use Tax Forms.

Some internet browsers have a built in pdf viewer that may not be compatible with our forms. Print and complete paper forms. Web how do i file state taxes? Web amended individual income tax return.

Web The Current Tavt Rate Is 7.0% Of The Fair Market Value Of The Vehicle.

Web or print a blank form to complete by hand. Series 100 georgia tax credits (except schedule 2b refundable tax credits) are claimed. Submitting this form for a prior tax year, will delay the. The other state(s) tax credit and low income credit are claimed directly on form 500.

Mail The Completed Forms And Other.

Web for 2023 (tax returns filed in 2024), georgia had six state income tax rates: The forms you’ll need to file are based on the type of state taxes you’re required to pay. Use this form for the 2022 tax year only. File individual state income taxes people who have earned income in georgia must file.