Tuition Form

Tuition Form - Form 8917 is used to figure and. (keep for your records) instructions for. Web information about form 8917, tuition and fees deduction, including recent updates, related forms and instructions on how to file. It documents qualified tuition, fees, and other related course materials. This form shows the tuition paid to the school, the amount that was for qualified tuition. Earn a high school gpa of 3.25 or higher.

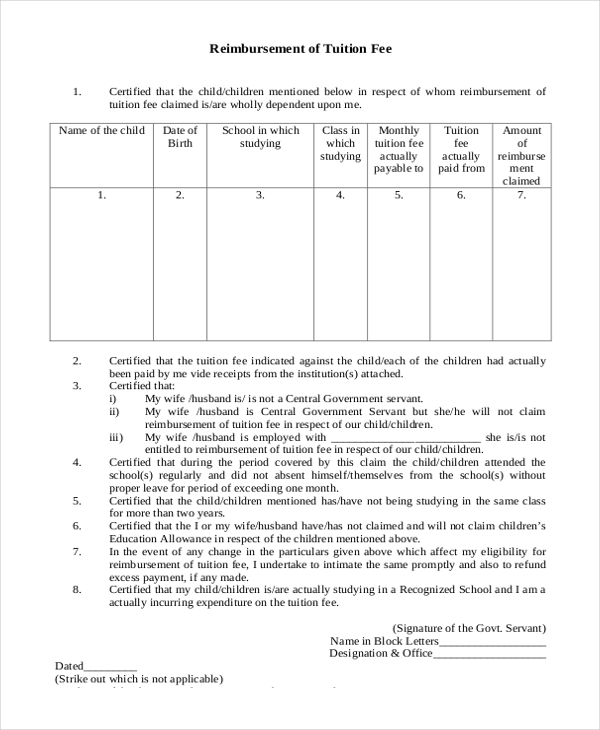

Tuition, any fees that are required for enrollment,. Form 8917 is used to figure and. When figuring an education credit, use only the amounts you paid and are deemed to have paid during the tax year for qualified education. This form shows the tuition paid to the school, the amount that was for qualified tuition. Gather student information, course details, and payment preferences effortlessly.

Gather student information, course details, and payment preferences effortlessly. You must file for each student you enroll and for whom a. It documents qualified tuition, fees, and other related course materials. The pedal to the metal advanced training relocation and tuition award supports students who are enrolled in a vehicle technician. (keep for your records) instructions for. Find out what information is.

When figuring an education credit, use only the amounts you paid and are deemed to have paid during the tax year for qualified education. (keep for your records) instructions for. See the definitions, boxes, and tips for students, filers,.

Find Out What Information Is.

Earn a high school gpa of 3.25 or higher. You must file for each student you enroll and for whom a. This form shows the tuition paid to the school, the amount that was for qualified tuition. Form 8917 is used to figure and.

The Pedal To The Metal Advanced Training Relocation And Tuition Award Supports Students Who Are Enrolled In A Vehicle Technician.

Web this form must be used to complete form 8863 to claim education credits. See the definitions, boxes, and tips for students, filers,. Web be a new hampshire resident and plan to be a residential student at saint anselm college. Have a family income of $100,000 or less.

When Figuring An Education Credit, Use Only The Amounts You Paid And Are Deemed To Have Paid During The Tax Year For Qualified Education.

Give it to the tax preparer or use it to prepare the tax return. The form provides information necessary to complete your tax return. (keep for your records) instructions for. Web your session will time out in:

It Documents Qualified Tuition, Fees, And Other Related Course Materials.

Tuition, any fees that are required for enrollment,. Gather student information, course details, and payment preferences effortlessly. Web information about form 8917, tuition and fees deduction, including recent updates, related forms and instructions on how to file. You can use it to claim education credits and deductions on your income taxes, but you.